By Kari Lukovics, Axial | May 17, 2017

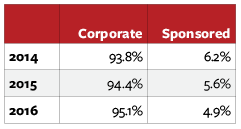

Per Axial data, sponsored (private equity) vs. corporate deal flow has remained fairly consistent over the past three years.

Sponsored deal flow has been spread evenly geographically with heavier activity in California, Texas, Florida and New York.

Here are thoughts of three lenders regarding sponsors vs. corporations:

What’s the difference from your perspective when working with sponsors vs. corporations on a deal?

“With sponsors, the positive is you’ve had someone who has probably already asked all of the right questions, therefore you can get very quick responses. That way it’s all packaged with a bow on it.

On the corporate side or the non-sponsor side, there is just a much heavier lift. It requires a high level of access to the business owner. I think there is also a large part of the market, on the non-sponsor side, that maybe doesn’t understand yet the total value proposition of this type of financing product. The company still might be of the mindset to call a budge bracket investment bank for an acquisition financing or my local bank down the street.”

– George Mueller, KKR Credit Advisors

What’s one factor that’s key to success in both both types of deals?

“Aligning interests. The best thing about working with sponsors is that they are sophisticated and they are motivated. The worst thing about working with sponsors is that they are sophisticated and they are motivated. Because of that, we always strive for alignment of interest.

When you are lending to a non-sponsor, such as a family business, the business might have a 20 or 30 year orientation, which might not match with the lender’s shorter term orientation. In these situations, alignment is also of utmost importance.”

– Gregg A. Bresner, CION Investment Management

What’s your advice for sponsors and corporations when communicating with lenders?

“Behind every credit committee meeting, every credit memo, every credit approval or decline, every credit covenant and every credit agreement are human beings. Fostering good relationships with those human beings requires effort, consistency, communication and time, but fostering good relationships with your lender is always a good long-term strategy for every business owner, CEO, and CFO.

The most important thing for non-sponsored businesses to do is provide good financial reporting. They can avoid surprises by taking the time to regularly communicate and meet with the decision makers at the bank on a regular basis.”

– Phil Kain, Rush Street Capital

For additional information regarding Florida business sales, acquisitions and valuations, please contact Eric J. Gall at Eric@EdisonAvenue.com or 239.738.6227. Also, visit our Edison Avenue website at www.EdisonAvenue.com. To search for Florida Businesses for Sale: CLICK HERE

No comments:

Post a Comment